Why Green Hydrogen Won't Take Off in the Middle East — But Green Ammonia Will.

Why Green Hydrogen Faces an Uphill Battle in the MENA Region

I once told a friend, “Producing green hydrogen for domestic use in the Middle East is economically unviable and a dealbreaker for investors. The real potential lies in exporting it to Europe, creating a new economic opportunity.”

To understand my point, it's essential to highlight a few key facts. Hydrogen is costly to produce and challenging to handle. Its use in vehicles demands robust engineering, impact-resistant storage, and rigorous safety testing due to its high flammability and ease of ignition. Any mechanical failure could pose a significant safety risk to passengers — a scenario that must be avoided at all costs.

Another factor slowing down the adoption of hydrogen fuel for general transportation is the competition with battery electric vehicles (BEVs), which have already surpassed hydrogen cars in terms of efficiency, reliability, and infrastructure readiness. Establishing EV charging stations is significantly simpler and more cost-effective than setting up hydrogen refueling stations. A clear example is the UK, where thousands of EV charging stations are available, while there are only five hydrogen refueling stations. If a shift away from gasoline cars were to occur, electric vehicles (EVs) would likely be the most adopted choice in the MENA region.

Cost is another major hurdle, especially in MENA region where gasoline is cheap and widely available. And that’s before even considering the cost of hydrogen-powered vehicles. Adopting green Hydrogen for transportation or even for industrial use is not economical especially when fossil fuel is widespread. Despite these challenges, green hydrogen is still being pursued as a decarbonization strategy. The question is: why?

The Cost Factor: A Tough Sell for Consumers

The major barrier to adopting green hydrogen in the Middle East is cost. Producing green hydrogen through solar-powered electrolysis costs around €3.54/kg, while gasoline in Saudi Arabia costs around $2.33 per gallon — making hydrogen an unappealing fuel option for cars in the region. Even if global hydrogen prices dropped or steam methane reforming (SMR) became widespread, logistics would still be a major challenge. Hydrogen requires high-pressure tanks or cryogenic cooling for storage, adding significant infrastructure costs. The liquefaction process alone can cost $3.2/kg of hydrogen, making the overall investment impractical. From an engineering standpoint, convincing investors to fund large-scale hydrogen infrastructure is nearly impossible without a strong economic case.

The practical solution lies in hydrogen carriers — converting hydrogen into more stable compounds like ammonia or methanol, which are easier to store, transport, and later convert back to hydrogen.

So Why All the Hype About Green Hydrogen?

The push for green hydrogen in the Middle East is driven by two main objectives:

- Advancing technological readiness for future hydrogen applications.

- Exporting hydrogen in the form of carriers (like ammonia) to international markets, unlocking economic gains — similar to Saudi Arabia's NEOM project.

Hydrogen can be converted into ammonia (by reacting with nitrogen) or methanol (by reacting with captured CO₂). These carriers are easier to ship and handle, allowing hydrogen to be transported globally and later decomposed to release hydrogen.

Some common hydrogen carriers include:

- Methanol

- Ammonia

- Liquid Organic Hydrogen Carriers (LOHC)

- Metal Hydrides

Europe, for instance, sees hydrogen as a key solution to reduce its reliance on fossil fuels and decarbonize heavy industries, and escaping carbon taxes. However, for the Middle East, the situation is different. Cheap gasoline and abundant fossil fuels make local hydrogen adoption impractical. Instead, the real opportunity lies in producing and exporting hydrogen derivatives, like ammonia. Ammonia is more energy dense than methanol and will be preferred for transport.

Ammonia cracking system:

Ammonia cracking is the process of decomposing ammonia (NH₃) into its basic components — hydrogen (H₂) and nitrogen (N₂) — through a high-temperature catalytic reaction. This reaction, which is the reverse of the Haber-Bosch process, operates around 800-1000°C and is represented as:

Ammonia serves as an efficient hydrogen carrier due to its higher energy density and mature transportation infrastructure compared to pure hydrogen. Depending on its production source, ammonia is classified as:

- Green Ammonia – Produced from renewable energy sources via electrolysis, offering carbon-free hydrogen.

- Blue Ammonia – Derived from natural gas with carbon capture and storage (CCS), reducing carbon emissions.

Centralized vs Decentralized Ammonia Cracking

Ammonia cracking can be categorized into two operational models based on the location of the cracking facility:

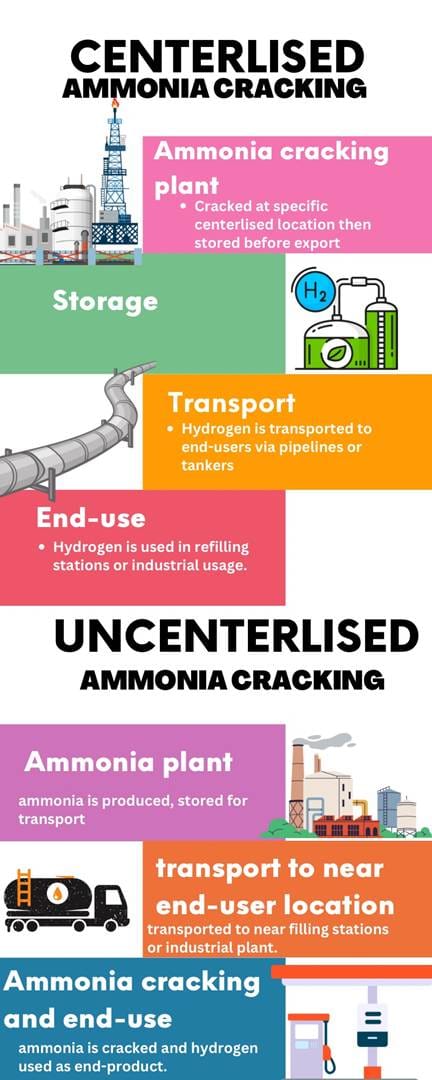

- Centralized Ammonia Cracking: Large-scale ammonia cracking facilities are built in industrial hubs or import terminals, where imported ammonia is cracked, purified, and then distributed as hydrogen via pipelines or tankers. This model offers economies of scale, higher efficiency, and lower cost per unit of hydrogen but requires substantial infrastructure investment. For instance, if ammonia is shipped from Saudi Arabia to Europe, it would be cracked at a centralized facility and supplied regionally.

- Decentralized Ammonia Cracking: In this model, ammonia is cracked on-site at the point of consumption, such as hydrogen refueling stations, industrial facilities, or power plants. While this approach eliminates hydrogen transportation costs, it introduces higher capital and operational costs due to the need for small-scale cracking units, lower efficiency, and complex infrastructure.

Why Green ammonia is more important than green hydrogen? For the MENA region to efficiently utilize green hydrogen domestically, it would require significant investment with no guaranteed return for investors, aside from aligning with COP28's vision and sustainable energy goals. However, exporting green hydrogen from the Middle East to Europe presents another challenge — it must compete with locally produced green hydrogen in Europe, which benefits from proximity to renewable energy sources. When factoring in the costs of transportation, storage, and energy conversion, Middle Eastern hydrogen may become economically uncompetitive in Europe.

A more promising approach, however, lies in green ammonia production. Unlike hydrogen, green ammonia offers better export potential as the MENA region can leverage its competitive renewable energy costs to produce ammonia at a lower price than in Europe.

Transforming hydrogen to ammonia, transporting this ammonia to end users , cracked to main components of hydrogen and nitrogen which then hydrogen could be sold at a better price.

This translates to a higher return on investment (ROI). One notable example is the NEOM project in Saudi Arabia, where green hydrogen is produced and converted into ammonia for export — a model that could prove more economically viable for the region.

Ammonia Cracking Process Explanation

The ammonia cracking process involves converting liquid ammonia (NH₃) into its fundamental components — hydrogen (H₂) and nitrogen (N₂) — through a high-temperature catalytic reaction. In this process, liquid ammonia is pumped into an ammonia cracker (reformer), which is essentially a large, fired heater or furnace. The high temperature in the furnace facilitates the decomposition of ammonia:

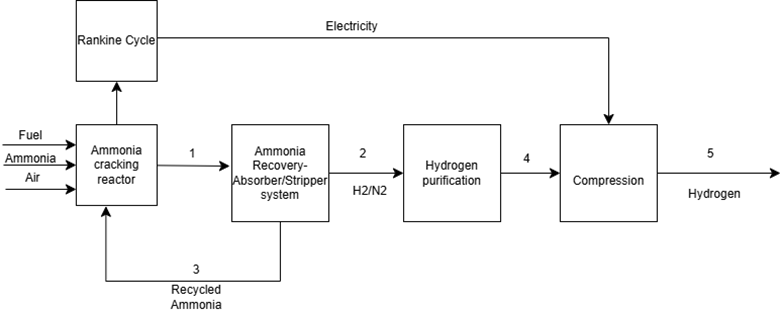

The heat required for the reaction is often supplied by a fired furnace, which can also be integrated with a waste heat recovery system. This system generates steam by heating boiler feed water, and the steam can subsequently be used in a Rankine cycle to produce power for the plant, enhancing overall process efficiency.

The effluent gas from the ammonia cracker (stream 2) primarily consists of hydrogen, nitrogen, and trace amounts of uncracked ammonia. To improve the conversion rate and prevent ammonia contamination, the effluent gas is sent to a recovery system consisting of an Absorber-stripper unit. In the absorber, water or another absorbent is introduced to selectively capture the residual ammonia, leveraging water's high affinity for ammonia. The treated gas (rich in hydrogen and nitrogen) exits from the top of the absorber and proceeds to the purification stage.

The absorbed ammonia, now dissolved in water, is regenerated in the stripper column. By applying heat, ammonia is separated from the water and then recycled back to the ammonia cracker Stream 3, increasing the overall conversion efficiency of the process. This continuous ammonia recovery minimizes raw material loss and optimizes reactor performance.

The hydrogen-nitrogen mixture is then directed to a hydrogen purification system, typically based on a cryogenic separation unit or pressure swing adsorption (PSA). One critical consideration during this stage is ensuring that the ammonia content in the hydrogen stream is reduced to below 0.1 ppm. This is particularly important for fuel cell applications, especially in Proton Exchange Membrane Fuel Cells (PEMFCs), where platinum-based catalysts are used at the anode. Any traces of ammonia in the hydrogen can adsorb onto the platinum surface, block active sites, and significantly reduce cell efficiency. Additionally, ammonia can contribute to corrosion of internal components, compromising fuel cell longevity.

According to the ISO 14687:2019 standard, the maximum allowable ammonia concentration in fuel cell-grade hydrogen is strictly limited to 0.1 ppm to prevent catalyst poisoning and ensure optimal fuel cell performance. Failure to meet this standard can drastically reduce power output and shorten the fuel cell's lifespan.

Once purified, the high-purity hydrogen is compressed and prepared for transportation or storage, allowing it to be delivered to end-users for fuel cell applications, power generation, or industrial use.